Own Gold

Coins & Bullions

Discover the timeless allure of gold coins and bullion at Own Gold. Whether you're a seasoned investor or new to precious metals, our collection offers a diverse range of options to suit every investment strategy. From iconic gold coins with historical significance to refined bullion bars of exceptional purity, each piece represents a tangible asset of enduring value and global recognition. Explore our selection and embark on a journey of wealth preservation and portfolio diversification with confidence and security.

“Let’s make history, together”

“Let’s make history, together”

Empower Your Financial Journey with Own Gold...

Whether you're a seasoned investor seeking to diversify your portfolio or a newcomer looking to enter the world of gold investments, Own Gold provides a reliable platform to achieve your financial goals. Join us today and unlock the potential for secure, high returns with confidence.

Key benefits: Physical Gold Coins & Bullion

Investing in gold coins or bars presents a formidable array of advantages for savvy investors seeking to fortify their portfolios. These tangible assets offer a steadfast store of value, resilient against the erosive forces of inflation and economic instability. By diversifying your investment holdings with gold, you can effectively hedge against market volatility, safeguarding your wealth with an asset class renowned for its stability and global acceptance.

Investors looking to purchase gold with a minimum of £1,000 benefit from accessibility and flexibility in building their precious metals portfolio. This minimum threshold allows individuals to start investing in gold coins and bars without needing substantial initial capital, making it a practical choice for a wide range of investors. Whether seeking to diversify investments, hedge against inflation, or preserve wealth, the £1,000 minimum purchase requirement ensures that gold remains accessible as a tangible and reliable asset for financial security and long-term wealth preservation strategies.

Investing in both gold coins and bars offers investors versatile options for acquiring physical precious metals. Gold coins are valued not only for their investment potential but also for their historical significance and collectible appeal. They are available in various sizes and designs, catering to different investment preferences and budgets. On the other hand, gold bars are typically larger in size and are favored by institutional investors and high-net-worth individuals due to their high purity and ease of storage. Both gold coins and bars provide tangible assets that retain value over time, offering investors flexibility, security, and a reliable hedge against economic uncertainty.

The process of purchasing gold coins and bullions via Own Gold is straightforward and accessible, making them an attractive investment option for both seasoned investors and newcomers alike. Investors can acquire gold via our website www.own-gold.com, or by calling us on 0800 233 5880. This simplicity in the buying process ensures that investors can swiftly add gold to their portfolios without unnecessary complexity or intermediaries. Moreover, the transparency and reliability ensures that investors can verify the authenticity and quality of their purchases, making gold a convenient and trusted asset for wealth preservation and portfolio diversification.

Gold coins and Bars that are LBMA (London Bullion Market Association) approved carry a prestigious mark of quality and authenticity. LBMA-approved gold coins adhere to stringent standards of purity, weight, and craftsmanship set by the LBMA, ensuring transparency and credibility in the precious metals market. Investors value LBMA-approved gold coins for their recognized global reputation, which facilitates easy buying, selling, and trading worldwide. This certification not only enhances liquidity but also provides assurance of the gold coin's authenticity and purity, making it a trusted choice for investors looking to acquire high-quality and globally recognised precious metals assets.

Gold coins and bars are valued as tangible assets, offering investors a physical form of wealth that can be held and stored securely. Unlike digital or paper investments, gold coins provide a tangible purchase that investors can physically possess and store. This characteristic not only enhances the appeal of gold coins as a secure store of value but also ensures direct ownership and control over the asset. The physical nature of gold coins adds an additional layer of security and assurance, making them a preferred choice for investors seeking tangible assets that hold intrinsic value and can be easily accessed or transferred as needed.

Gold coins serve as a reliable store of value due to their enduring purchasing power and intrinsic worth. Throughout history, gold has maintained its value over extended periods, often appreciating during economic instability or inflationary pressures. As a tangible asset with global recognition, gold coins provide investors with a secure and stable store of wealth that transcends geopolitical boundaries. This characteristic makes gold coins a trusted choice for preserving purchasing power over time, safeguarding against currency devaluation, and ensuring the preservation of capital for future generations.

Gold coins play a crucial role in portfolio diversification by offering a distinct asset class that typically exhibits low correlation with traditional financial assets like stocks and bonds. This lack of correlation means that gold coins can act as a counterbalance to market volatility, potentially reducing overall portfolio risk. Including gold coins in a diversified investment portfolio can help investors achieve greater stability and resilience against economic uncertainties and fluctuations in other asset classes. Moreover, gold's historical performance as a safe-haven asset underscores its value in enhancing portfolio diversification and protecting wealth over the long term.

Gold coins enjoy widespread global acceptance, making them a universally recognized store of value. Due to their historical significance and intrinsic value, gold coins are accepted as a form of currency and investment across diverse cultures and economies worldwide. This global acceptance ensures that investors can trade gold coins seamlessly in international markets, accessing liquidity and diversifying their portfolios with a trusted asset that transcends geographical boundaries. Whether buying, selling, or holding for wealth preservation, gold coins offer investors unparalleled flexibility and assurance in the global financial landscape.

Gold coins offer liquidity, allowing investors to easily convert them into cash when needed. Unlike other physical assets, such as real estate or collectibles, gold coins have a well-established global market with active buyers and sellers. This liquidity ensures that investors can swiftly liquidate their holdings without significant loss of value, providing flexibility and financial security during times of urgency or opportunity. Whether selling through reputable dealers, auctions, or online platforms, gold coins maintain their marketability, making them a reliable asset for meeting short-term financial needs.

Gold coins are renowned for their role in wealth preservation. As a tangible asset with intrinsic value, gold has consistently maintained its worth through economic downturns and market fluctuations. Unlike fiat currencies that can depreciate due to inflation or geopolitical uncertainties, gold coins provide a stable store of value over the long term. This characteristic makes them a preferred choice for investors looking to safeguard their wealth against economic volatility and ensure capital preservation for future generations.

Gold coins also serve as a reliable hedge against inflation. Historically, gold has preserved its purchasing power over time, often appreciating in value during periods of economic uncertainty or rising inflation. This inherent stability makes gold coins a valuable asset for investors seeking protection against the erosion of currency value. By holding gold coins, investors can potentially mitigate the impact of inflation on their wealth and maintain financial stability in fluctuating economic conditions.

Investing in gold coins can offer tax efficiency advantages for investors. In many jurisdictions, certain gold coins are considered legal tender or are exempt from VAT or sales tax, making them a tax-efficient asset class. Additionally, capital gains taxes on gold coins may be lower compared to other investments, depending on local tax laws. This makes gold coins an attractive option for investors looking to diversify their portfolio while optimising their tax obligations.

Gold Bars

- OWN YOUR FUTURE

Your Trusted Source for Precious Metals

At Own Gold, we believe in the enduring value of gold. For centuries, gold has been a symbol of wealth, stability, and prosperity. Whether you're a seasoned investor or new to precious metals, our expertly curated collection of gold bars and coins offers something for everyone.

View Availability"Gold is more than a commodity; it is a universal symbol of wealth and power, a testament to enduring value in an ever-changing world."

Bullion Gold Bars

Suitable for gold buyers wishing to buy huge quantities. Gold bars are more convenient to store but offer less flexibility and more illiquidity than gold coins. Private mints manufacture gold bars. They are not considered legal currency and as such are liable to CGT.

Gold bars offer impeccable purity and uniformity, making them an ideal choice for buyers seeking large-scale investments. Their standardised specifications, often certified by recognised mints or refineries, ensure authenticity and integrity.

The larger size of gold bars typically translates to lower premiums per ounce compared to smaller denominations, maximising the potential for cost-effective acquisitions, particularly for those purchasing significant quantities.

Despite not being legal currency, gold bars serve as a tangible hedge against inflation and currency devaluation, providing long-term wealth preservation benefits for investors seeking stability and security.

Gold bars are non-CGT (Capital Gains Tax) liable assets in many jurisdictions, offering potential tax advantages for investors. This favourable tax treatment enhances the overall appeal of gold bars as a strategic addition to investment portfolios.

While gold bars may be less flexible and more illiquid compared to gold coins, their larger size offers advantages in terms of storage efficiency and security for investors with ample storage space.

Graded Gold Coins

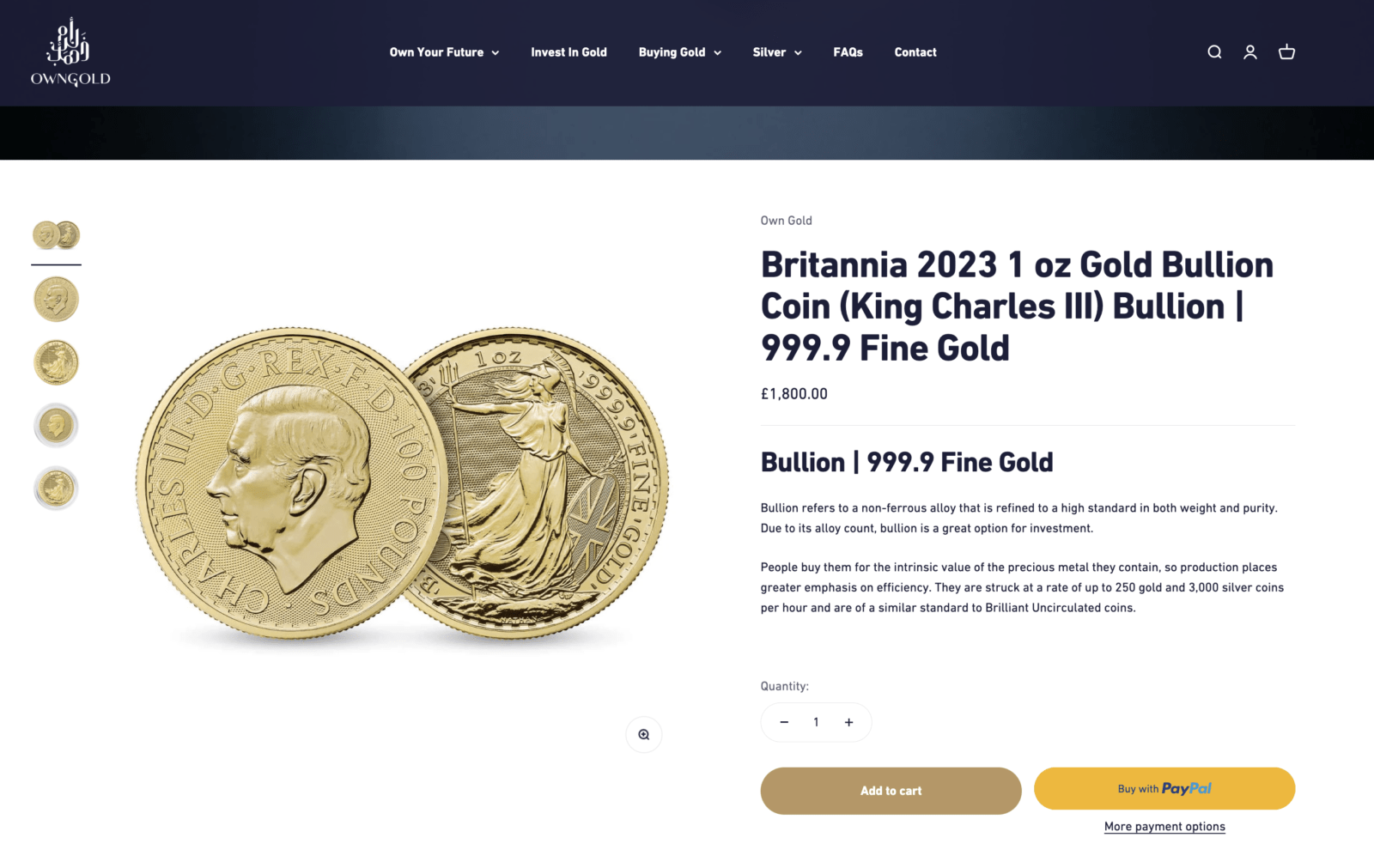

Ungraded gold coins are almost never worth more than graded gold coins. Since there is no assurance of grade, condition, or authenticity, ungraded coins involve some risk. All of the gold coins we provide are made by a sovereign government’s mint and have the status of being accepted as legal money. Gold coins are therefore exempt from both VAT and CGT.

Graded gold coins provide investors with a level of assurance regarding their quality, condition, and authenticity. Each coin undergoes professional grading by reputable grading services, ensuring accurate assessment and certification.

Graded gold coins typically command higher premiums compared to ungraded coins due to their certified quality and authenticity. Investors may realise greater returns on their investment when buying and selling graded coins.

Graded gold coins often carry numismatic value in addition to their intrinsic gold content. Collectors may be drawn to graded coins for their historical significance, rarity, and aesthetic appeal, further enhancing their value over time.

Grading services employ stringent authentication measures to detect and deter counterfeiting. By investing in graded coins, investors mitigate the risk of purchasing counterfeit or altered coins, safeguarding their investment capital.

Graded gold coins are widely recognised and accepted within the numismatic and investment communities. Their standardised grading and certification facilitate ease of transaction, providing liquidity and marketability for investors.

Gold Coins

Perfect for investors who want to sell the majority or a portion of their holdings in the next to mid-term. Gold coins often provide much greater purchase flexibility and liquidity when compared to gold bars. Each and every one of the gold coins that we provide is produced by a sovereign government’s mint, presenting the circumstance in an appropriate manner. Hence, gold coins are exempt from both CGT and VAT.

Gold coins offer investors greater flexibility and liquidity compared to gold bars, making them an ideal choice for those who anticipate selling a portion or the majority of their holdings in the near to mid-term. The ability to easily sell or trade gold coins in various denominations allows investors to adapt to changing market conditions and capitalise on opportunities as they arise.

Gold coins come in a wide range of sizes, designs, and denominations, providing investors with diverse options to suit their investment preferences and goals. Whether seeking smaller denominations for incremental purchases or larger coins for long-term investments, gold coins offer versatility to accommodate different investment strategies.

Many gold coins carry numismatic or collector value in addition to their intrinsic gold content. Coins with historical significance, unique designs, or limited mintages may appreciate in value over time, offering potential returns beyond the gold market's performance.

Gold coins produced by sovereign government mints enjoy widespread recognition and acceptance worldwide as legal tender currency. This universal recognition enhances the marketability and liquidity of gold coins, enabling investors to buy, sell, or trade them with ease in international markets.

Gold coins, being legal tender, are often exempt from Value Added Tax (VAT) and Capital Gains Tax (CGT) in many jurisdictions. This favourable tax treatment enhances the overall appeal of gold coins as an investment vehicle, allowing investors to maximise their returns without tax implications.

"Transform your financial future with Own Gold - Where every investment shines brighter. Start your journey to prosperity today!"

Start Your Investment Journey TODAY!

Ready to embark on a golden opportunity? Get in touch to discuss your requirements

Leave us a detailed message and one of our specialists will contact you to discuss the best options available for your investment plans.

Request a call back

"Own Gold: Your trusted gateway to timeless investments. Discover expert guidance, global reach, and exceptional service for your wealth preservation goals."

Investment Opportunities

Our carefully curated investment opportunities offer a gateway to potential growth and prosperity. Whether you're seeking short-term gains or long-term stability, we provide tailored solutions to suit your financial goals. Explore our offerings today and embark on your journey towards financial success."

"Embracing the Eternal Legacy of Gold"

Meet the co-founders

Discover the Visionaries Fueling Own Gold's Success — Meet Our Co-Founders. With a relentless pursuit of excellence and a deep-rooted commitment to ethical practices, they spearhead our efforts in redefining the gold investment sector. Learn about their diverse expertise, unwavering values, and forward-thinking vision, driving us towards a future of unparalleled investment opportunities

CARMEN KENNISON-BROOKS

Carmen’s reputation precedes her, celebrated for her exceptional aptitude in nurturing and expanding multi-million-pound enterprises within the finance and investment sphere. At Own Gold, she orchestrates a myriad of investment ventures, implementing strategies that capitalise on lucrative opportunities. Her adeptness in driving unparalleled growth and success for the company and its investors is unmatched.

LAUREN WARLOW

Lauren embodies seasoned leadership, boasting a wealth of experience in orchestrating and optimising operational endeavours on a global scale. Throughout her tenure, she has exhibited an unwavering commitment to steering the company’s operational facets, strategically safeguarding its assets, and crafting robust frameworks that lay the foundations for sustainable financial growth for both partners and investors alike.