“Let’s make history, together”

“Let’s make history, together”

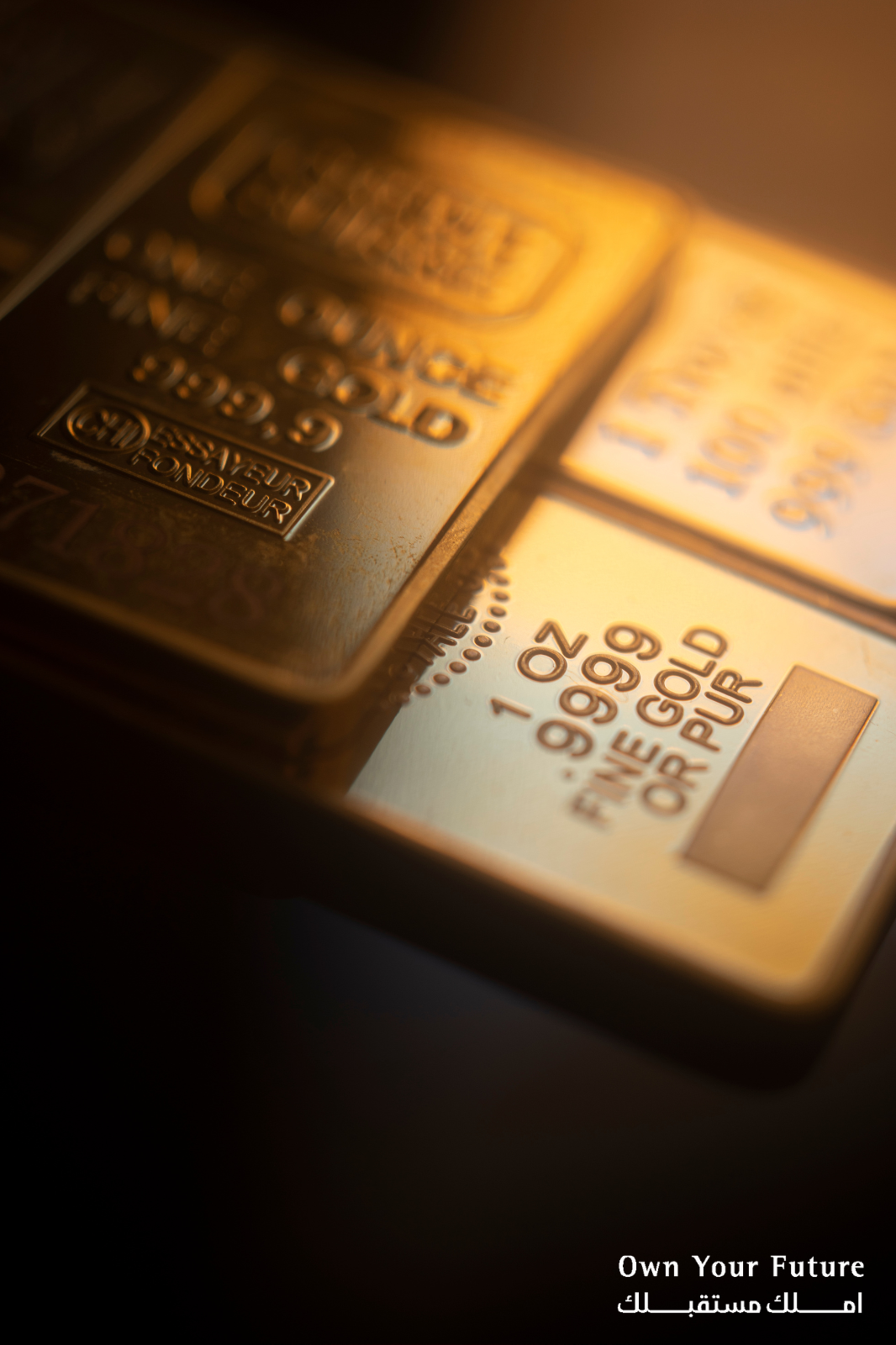

Empower Your Financial Journey with Own Gold...

Whether you're a seasoned investor seeking to diversify your portfolio or a newcomer looking to enter the world of gold investments, Own Gold provides a reliable platform to achieve your financial goals. Join us today and unlock the potential for secure, high returns with confidence.

About IFISA:

Own Your Future

Unlike traditional cash ISAs or stocks and shares ISAs, an Innovative Finance ISA focuses on peer-to-peer lending and bond/debenture investment opportunities. This means investors have the potential to earn higher interest rates compared to traditional investment options.

The Innovative Finance ISA was introduced by the UK government in 2016 to promote peer-to-peer lending and provide investors with an alternative and potentially more lucrative investment avenue. By investing through an IFISA, individuals can support businesses and individuals in need of financing, while potentially earning tax-free returns on their investments.

Whether you're a seasoned investor or new to the financial world, an Innovative Finance ISA presents an attractive opportunity to diversify your investment portfolio and potentially increase your earnings in a tax-efficient manner.

IFISA

Why We Are Different

From direct gold ownership to innovative investment vehicles, we offer a range of opportunities to diversify your portfolio and capitalise on the enduring value of gold. Take a step towards securing your financial future with confidence.

History

An Innovative Finance ISA offers tax-free returns on investments in innovative finance opportunities.

High Returns

IFISAs focus on peer-to-peer lending and bond/debenture investment opportunities.

Security

Investing in an Innovative Finance ISA can potentially earn higher interest rates, albeit this comes with higher risk.

No Market Risk

The IFISA was introduced by the UK government in 2016 to promote peer-to-peer lending.

History

An Innovative Finance ISA offers tax-free returns on investments in innovative finance opportunities.

High Returns

IFISAs focus on peer-to-peer lending and bond/debenture investment opportunities.

Security

Investing in an Innovative Finance ISA can potentially earn higher interest rates, albeit this comes with higher risk.

No Market Risk

The IFISA was introduced by the UK government in 2016 to promote peer-to-peer lending.

Benefits of an Innovative Finance ISA

By opening an Innovative Finance ISA, you can take advantage of tax-free returns, potentially higher interest rates, and the unique tax treatment offered by these ISAs.

Consider exploring the innovative finance options available through these ISAs to maximize your returns and diversify your investment portfolio.

However, it’s essential to carefully assess the risks associated with innovative finance investments and ensure they align with your financial goals and risk tolerance.

Tax-Free Returns

One of the main advantages of an Innovative Finance ISA is that it can provide tax-free returns on your investment, within your annual £20,000 ISA allowance. This means that any interest you earn within the ISA are not subject to income tax or capital gains tax.

Potentially Higher Interest Rates

Compared to traditional savings accounts, Innovative Finance ISAs often offer potentially higher interest rates.

This is because these ISAs provide opportunities to invest in innovative finance options, such as peer-to-peer lending and bond/debenture investments, which can generate higher returns compared to traditional methods, however it may come with increased risk.

Tax Treatment

Innovative Finance ISAs have their own specific tax treatment. Unlike other ISAs, such as cash ISAs or stocks and shares ISAs, the tax treatment of an Innovative Finance ISA depends on the investments held within the ISA. It's important to consult with a financial advisor or tax professional to understand the specific tax implications based on your investment portfolio. By opening an Innovative Finance ISA, you can take advantage of tax-free returns, potentially higher interest rates, and the unique tax treatment offered by these ISAs. Consider exploring the innovative finance options available through these ISAs to maximize your returns and diversify your investment portfolio. However, it's essential to carefully assess the risks associated with innovative finance investments and ensure they align with your financial goals and risk tolerance.

Investment Options within an Innovative Finance ISA

When it comes to investing within an Innovative Finance ISA, there are a range of options available to suit different investment strategies and risk appetites. Two common investment options within an IFISA are loan-based securities and asset-backed securities.

Investment Options within an Innovative Finance ISA

When it comes to investing within an Innovative Finance ISA, there are a range of options available to suit different investment strategies and risk appetites. Two common investment options within an IFISA are loan-based securities and asset-backed securities.

Security

Loan-based securities are investments that involve lending money to individuals or businesses in return for interest payments. This type of investment can provide a fixed income stream over a predefined period. Some IFISA providers offer platforms that allow investors to choose specific loans to fund, providing a more hands-on approach to lending.

Returns

Asset-backed securities are investments that are backed by a pool of physical assets, such as property or equipment. These investments provide potential returns through rental income, capital appreciation, or a combination of both. Asset-backed securities diversify investment portfolios and may offer a degree of stability due to the underlying tangible assets.

Exit

For loan-based securities, investors typically have the option to sell their loans on a secondary market, if available, allowing for early exit before the loan term ends. This provides flexibility and access to capital if needed. For asset-backed securities exit strategies might include the sale of the underlying assets or receive payouts from the maturity of the investment.

Meet the co-founders

Get to know the driving forces behind Own Gold — our dedicated co-founders. With a shared passion for innovation and a commitment to integrity, they lead our team in revolutionising the gold investment landscape. Learn more about their expertise, values, and vision for the future of investing.

CARMEN KENNISON-BROOKS

Carmen’s reputation precedes her, celebrated for her exceptional aptitude in nurturing and expanding multi-million-pound enterprises within the finance and investment sphere. At Own Gold, she orchestrates a myriad of investment ventures, implementing strategies that capitalise on lucrative opportunities. Her adeptness in driving unparalleled growth and success for the company and its investors is unmatched.

LAUREN WARLOW

Lauren embodies seasoned leadership, boasting a wealth of experience in orchestrating and optimising operational endeavours on a global scale. Throughout her tenure, she has exhibited an unwavering commitment to steering the company’s operational facets, strategically safeguarding its assets, and crafting robust frameworks that lay the foundations for sustainable financial growth for both partners and investors alike.

Looking for a collaboration?

We’re here to help

Ready to embark on your journey to financial success? Contact us today and discover how our expert team can help you navigate the world of wealth accumulation and preservation. Let’s turn your financial goals into reality together!