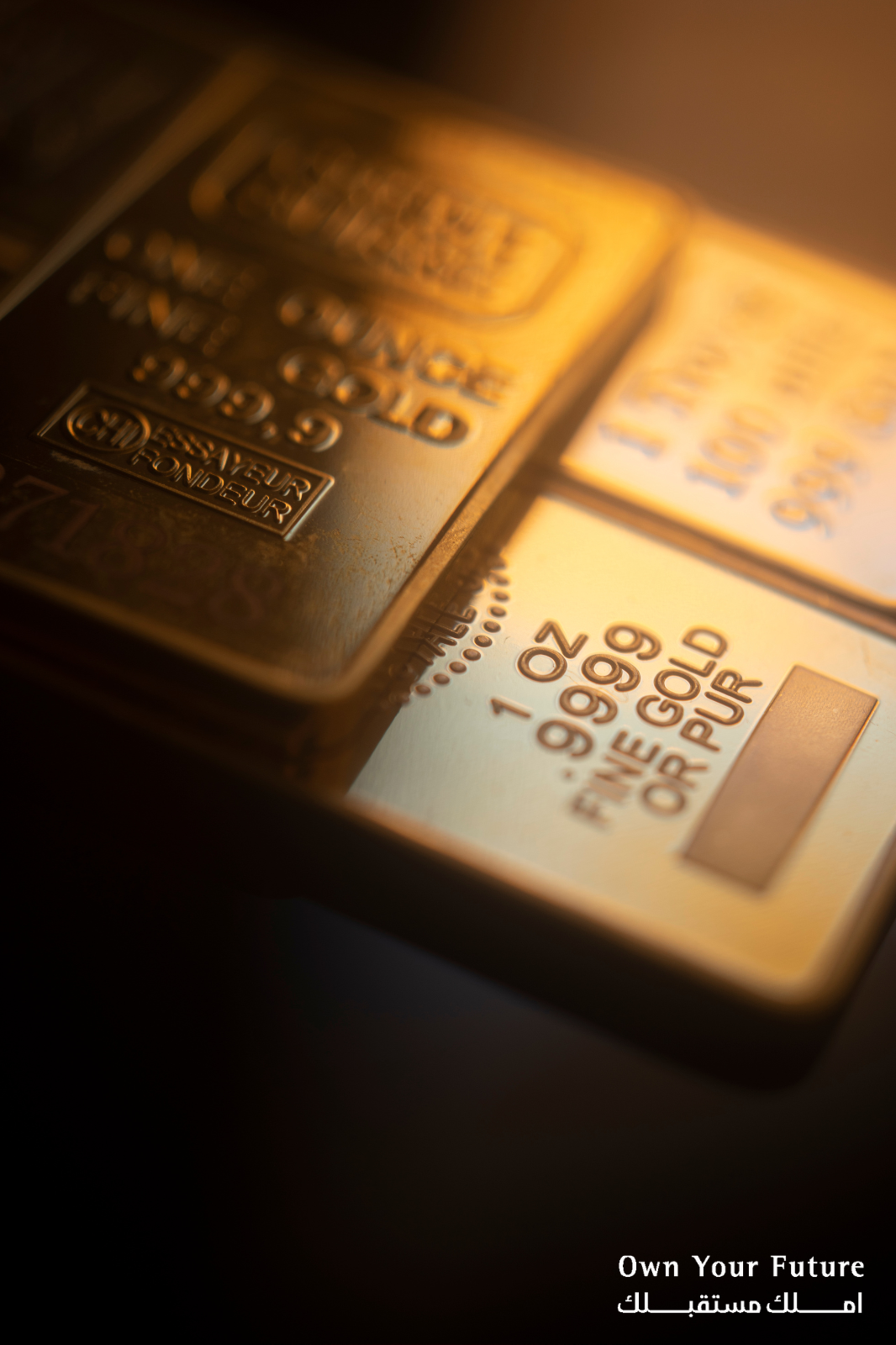

Own Gold

GOLD PENSION INVESTMENTS

Investing through pensions offers a tax-efficient way to save for your future. With gold pension investments ranging from workplace and personal pensions to specialised schemes like QROPS, you can tailor your retirement savings to your unique needs. By leveraging professional management and diverse investment opportunities, pensions help build a robust financial foundation for a comfortable retirement. By investing with Own Gold, individuals can diversify their pension funds across a wide range of different income options.

Gold is money. Everything else is credit.

Gold is money. Everything else is credit.

Gold is money. Everything else is credit.

Empower Your Financial Journey with Own Gold...

Whether you're a seasoned investor seeking to diversify your portfolio or a newcomer looking to enter the world of gold investments, Own Gold provides a reliable platform to achieve your financial goals. Join us today and unlock the potential for secure, high returns with confidence.

Gold Pension Investments

Own Your Future

Considering gold pension investments? Investing via a pension is a smart strategy for securing your financial future. Pensions offer a tax-efficient way to save for retirement, with contributions often benefiting from tax relief, which boosts the amount going into your pension pot. By investing through a pension, you can take advantage of compound growth over the long term, as your investments have the potential to grow tax-free.

One of the most significant advantages of gold pension investments is the tax relief on contributions. Depending on your income tax band, you could receive tax relief at 20%, 40% , or even 45%, meaning the government essentially boosts your savings.

Many employers offer pension schemes with matching contributions, which can significantly increase your retirement savings. This is essentially free money added to your pension pot.

Investing through a pension allows your savings to grow over time through compound interest. The earlier you start, the more time your money has to grow, maximising your retirement fund.

Pension funds are typically invested in a mix of assets, including stocks, bonds, and property. This diversification helps spread risk and can lead to more stable returns over the long term, with gold pension investments offering a robust alternative asset for portfolios.

Pension funds are usually managed by professional fund managers who make investment decisions on your behalf. This can help optimise the growth of your investments and manage risk.

Pension schemes are regulated to ensure they meet certain standards and offer protection for your investments. This regulation provides peace of mind that your savings are being managed responsibly.

Pensions provide various options for accessing your money in retirement, including lump sums, regular income, or a combination of both. This flexibility allows you to tailor your retirement income to your needs and lifestyle.

Pensions can be passed on to your beneficiaries, often free of inheritance tax. This ensures that your loved ones can benefit from your savings after you pass away.

PENSION

Secure Your Future: The Advantages of Gold Pension Investments

Gold pension investments are not just about saving money. It’s about securing a comfortable and financially stable future. By taking advantage of the tax benefits, compound growth, and professional management that pensions offer, you can build a robust retirement fund that supports your long-term financial goals.

State Pension

The State Pension is a regular government payment based on your National Insurance contributions. It provides a basic, inflation-adjusted income during retirement, ensuring a stable financial foundation.

Learn moreStakeholder Pensions

These are flexible and low-cost pensions that you can set up independently. They feature flexible contributions and capped charges, making them accessible for many savers.

Learn moreSelf-Invested Personal Pension (SIPPs)

SIPPs provide greater control over your investment choices, including stocks, bonds, and property. They are ideal for experienced investors seeking a wide range of investment options.

Learn moreAdditional Voluntary Contributions (AVCs)

AVCs allow you to make extra contributions to your workplace pension. They help boost your pension savings and offer additional tax relief, enhancing your retirement fund.

Learn moreSmall Self-Administered Schemes (SSAS)

SSAS are pension schemes designed for small businesses, often set up by company directors. They offer flexibility in investment choices, including loans to the sponsoring employer, and provide significant control over pension funds.

Learn moreQualifying Recognised Overseas Pension Schemes (QROPS)

QROPS are overseas pension schemes that meet HMRC requirements, beneficial for UK expatriates. They offer flexibility in currency options, potential tax advantages, and the ability to consolidate multiple pensions into one.

Learn more

Dive into the world of gold investments

Where robust figures paint a compelling picture of opportunity and stability

In 2023/2024, annual gold production maintained its robust pace, with approximately 3,000 metric tons mined worldwide. Central banks continued to fortify their reserves, amassing over $1.5 trillion worth of gold assets.

Global gold demand remained buoyant, reaching 4,041 metric tons, driven by investment, jewellery and technological applications. Against this backdrop, gold prices surged, reaching new heights, with the market witnessing an all-time high of over $2,000 per ounce. The soaring popularity of gold-backed exchange-traded funds (ETFs) was evident, with holdings surpassing $200 billion. Moreover, the gold mining industry’s contribution to global GDP exceeded $100 billion, while the gold jewellery market flourished, valued at over $230 billion.

Against the backdrop of economic uncertainty, gold stands as a steadfast pillar of stability, offering investors a compelling opportunity for wealth preservation and growth in the dynamic financial landscape of 2023/2024.

"Transform your financial future with Own Gold - Where every investment shines brighter. Start your journey to prosperity today!"

"The Golden Impact: Transforming Communities and Economies"

Explore the profound impact of gold mining with these compelling statistics.

From driving the economic growth and infrastructure development to supporting millions of livelihoods and fostering environmental stewardship, the gold mining industry plays a pivotal role in shaping a sustainable future for communities worldwide.

$2B

Environmental Stewardship

The gold mining industry invests over $2 billion annually in environmental protection measures, including reclamation efforts and biodiversity conservation.

15M

Employment Opportunities

The gold mining industry supports over 15 million direct and indirect jobs globally, providing livelihoods for communities in mining regions.

40M

Support for Small-Scale Miners

The artisanal and small-scale gold mining sector provides livelihoods for over 40 million people worldwide, with responsible mining initiatives supporting sustainable development in rural communities.

$1B

Community Development

Responsible gold mining companies invest over $1 billion annually in community development initiatives, including education, healthcare, and sustainable livelihood programs.

$100B

Infrastructure Development

Gold mining catalyses infrastructure projects, with investments exceeding $100 billion in roads, power lines, and water infrastructure in mining regions.

70+

Global Production

Gold is mined in over 70 countries worldwide, the annual yield of gold reaches a staggering 3,000 metric tons, fuelling economies and shaping markets worldwide.

Meet the co-founders

Get to know the driving forces behind Own Gold — our dedicated co-founders. With a shared passion for innovation and a commitment to integrity, they lead our team in revolutionising the gold investment landscape. Learn more about their expertise, values, and vision for the future of investing.

CARMEN KENNISON-BROOKS

Carmen’s reputation precedes her, celebrated for her exceptional aptitude in nurturing and expanding multi-million-pound enterprises within the finance and investment sphere. At Own Gold, she orchestrates a myriad of investment ventures, implementing strategies that capitalise on lucrative opportunities. Her adeptness in driving unparalleled growth and success for the company and its investors is unmatched.

LAUREN WARLOW

Lauren embodies seasoned leadership, boasting a wealth of experience in orchestrating and optimising operational endeavours on a global scale. Throughout her tenure, she has exhibited an unwavering commitment to steering the company’s operational facets, strategically safeguarding its assets, and crafting robust frameworks that lay the foundations for sustainable financial growth for both partners and investors alike.