Gold Investment in 2025: A Haven of Stability Amid Global Tensions

In an era marked by escalating US tariff wars and unprecedented market volatility, gold continues to prove its worth as a cornerstone of strategic investment portfolios, making gold investment in 2025 a viable option for global investors.

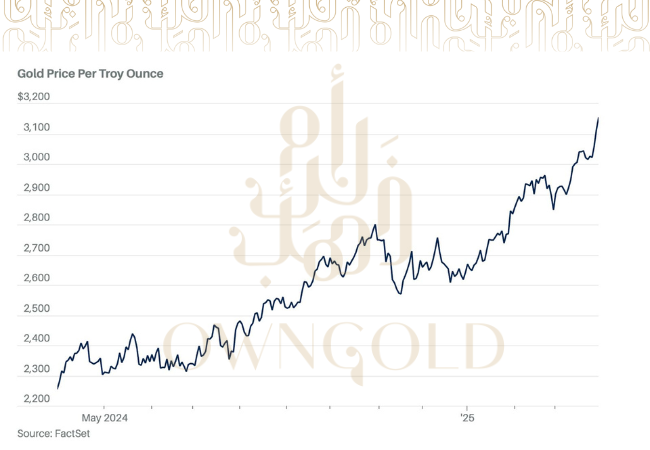

Gold prices reached a remarkable $3,150 per ounce on March 31, 2025, demonstrating the precious metal’s resilience and upward trajectory in uncertain economic times.

Here is what you need to know if you are considering gold investment in 2025.

Market Overview

The current economic landscape, particularly affected by ongoing US trade tensions, presents a compelling case for gold investment.

With the Bank of England’s modest growth forecast of 0.75% and inflation at 3.7%, investors are increasingly seeking stable alternatives to traditional investments.

The impact of US tariff policies has sent shockwaves through global markets, causing significant volatility in equity markets and international trade relationships.

This uncertainty has prompted a fundamental reassessment of portfolio diversification strategies.

The Tariff Effect

The continuation of US trade disputes has created:

- Supply chain disruptions affecting global markets

- Currency fluctuations impacting international trade

- Increased market uncertainty and volatility

- Shifting international trade alliances

- Growing need for portfolio diversification

Why Gold Now?

As global markets grapple with trade tensions and economic uncertainty, gold’s historical role as a hedge against market volatility has become particularly relevant in 2025.

Several key factors are driving this trend:

- Geopolitical uncertainty and trade tensions

- Fluctuating interest rates

- Increased Central Bank demand

- Portfolio protection benefits

- Currency hedging against potential trade-war impact

As you can see from this graph, gold’s value continues to hold strong despite what’s happening across the global market.

Professional Gold Investment Solutions

While many investors recognise gold’s potential as a portfolio stabiliser during trade disputes, accessing the market effectively can be challenging. Own Gold, with its global presence across London, Dubai, Singapore, and Australia, provides sophisticated investors with secure and profitable pathways to gold investment.

Own Gold’s Investment Advantages:

- Reliable Returns: Unique model generating returns from gold sales within one month

- Security First: Funds held in trust with robust investor protection measures

- Market Risk Mitigation: Strategic gold purchasing at discount rates

- Proven Track Record: 98% investor retention rate, highlighting consistent performance

- Global Infrastructure: International presence providing stability amid trade tensions

Follow the link to view Own Gold’s investment options for sophisticated and high-net-worth investors.

Portfolio Diversification Strategy

In light of ongoing trade tensions and market volatility, diversification has become crucial for portfolio resilience.

Gold’s performance during recent trade disputes has highlighted its effectiveness as a portfolio stabiliser. Own Gold’s investment structures provide a professional avenue for investors seeking to incorporate this strategic asset into their portfolios.

The Future of Gold Investment

As we progress through 2025, market analysts predict continued strength in gold prices, supported by ongoing trade uncertainties and economic tensions. Gold’s proven track record further reinforces this outlook as a stable store of value during periods of international trade disputes.

Security and Trust

Own Gold’s commitment to investor security is evidenced through:

- UK Security Trustee oversight

- Transparent monthly reporting

- Asset-backed security structure

- Global infrastructure trust

- Consistent monthly returns

Considering Gold Investment in 2025?

With a minimum investment threshold of £25,000, Own Gold provides accessible entry points for sophisticated investors. Their comprehensive support structure and professional management team ensure that investors receive expert guidance throughout their investment journey.

For those looking to secure their financial future with a gold investment in 2025, Own Gold offers a consultation service to discuss individual investment needs and objectives. Interested parties can reach out via their website www.own.gold or contact our investment team at invest@own-gold.com.

Investing involves risk. Please review our Risk Warning.